About Start Software

Start Software is an award-winning developer and leading publisher of asbestos software, systems for the legal services industry and more.

Want to know more about asbestos software Alpha Tracker? Alpha Tracker is the most used asbestos software in the UK, Australia & New Zealand with more than 60m items of asbestos data stored.

Our legal services software Alpha Legal helps will writers, accountants, solicitors, IFAs and estate agents to communicate securely with clients. Read about developments here on the blog.

Or need help with Alpha Anywhere or Alpha Transform projects or software development? You'll find useful info here.

We've had a query from the finance department of a consultancy using Alpha Tracker to manage their business. They use Alpha Tracker to raise their invoices, and sometimes notice that the VAT total is a few pence different to the amount expected.

For example, let's say that you charge £12.12 for an asbestos sample and you want to raise an invoice for five samples to your client. The vat rate is 20%. Here is the invoice:

Each line is invoiced at £12.12+vat. 20% of £12.12 is £2.424 which rounds down to £2.42 vat on each line.

The total net is 5 x £12.12 or £60.60. The vat total is 5 x £2.42 or £12.10. That gives an invoice total of £72.70 and that is what Alpha Tracker will display on screen, on the invoice PDF, and will transfer to finance packages Xero, QuickBooks or Sage (see this web page for all of our integration options https://alpha-tracker.co.uk/integrations).

However... 20% of £60.60 is actually £12.12, so shouldn't the total be £72.72? In other words, calculating the vat on each line and totalling it, is giving a different result to calculating the vat on the total net.

HMRC (the UK tax authority) is well aware of this dilemma and allow either the "add up the vat on each line" or the "calculate VAT on the total net" method to be used on an invoice. They have posted a web page about it here: https://www.gov.uk/guidance/vat-guide-notice-700#section17.

For more information, do contact our Support Desk or read the following helpful information from Xero, the global leader of online accounting software for small businesses: https://central.xero.com/s/article/How-VAT-works-in-Xero-UK#Whatyouneedtoknow

Popular posts from this blog

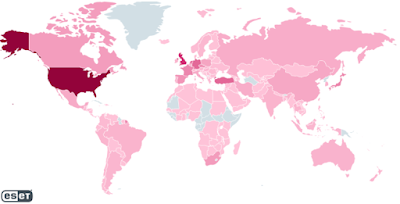

The news has been full of a new cyber-security threat that has been causing havoc since the start of the month. Log4j , as it is known, is one of the worst server vulnerabilities to ever have been discovered. In fact, some experts say it is the worst. There's a really good summary of the threat here, on Wired.com: https://www.wired.com/story/log4j-log4shell/ The Log4j vulnerability gives hackers the opportunity to do virtually anything on a compromised server - from running bitcoin mining software (causing your server to run at full speed, essentially disabling all of your server running on it) to exposing user names and passwords, or even installing dreaded ransomware. The UK has been particularly hit with attacks, as this graphic shows: The UK and North America are amongst the areas seeing most hacking attempts At Start Software, we take security really seriously and we have already checked the servers which run asbestos software Alpha Tracker , leg...

664 support calls answered in November 2021 - phew!

Our 24x7 Support Desk had a busy November answering 664 calls. It was the usual mixture of questions, queries, suggestions and problems - all good fun! Busy month on the Support Desk! Overall, we maintained our good performance from the month before with 19 out of 20 queries being resolved within the timescales set by our clients.

Great customer feedback x 3!

Three emails just arrived one after the other - and each put a smile on our faces and a spring in our step! Feedback #1... "We smashed our audit! Thank you so much for your help" from a new customer where we have been providing Alpha Five support and mentoring to help them to develop an Intranet quality & audit system Feedback #2... "hi Tom. It looks fantastic! Very well done" from a client reviewing the latest changes to a web data analysis system we have written using Alpha Anywhere , SQL Server and JavaScript Feedback #3... " The launch of Alpha Tracker here is going really well ... thank you so much" from an asbestos consultancy feeling the benefits of their Alpha Tracker asbestos software installation. We really appreciate it when customers take the time to send us feedback like this - it makes the hard work seem worthwhile!

Blog Archive

-

-

-

-

- iOS17 problem fixed with Tracker Mobile! Download ...

- Alpha Draw webinar on Tuesday 31 October at 12:30 ...

- Step-by-step guide to our Write a Will feature now...

- Microsoft Teams <-> Alpha Tracker integration impr...

- How does Alpha Tracker calculate VAT on an invoice...

- Mobile Data (Tracker Mobile) issue with iOS17 (the...

- Alpha Tracker is exhibiting at the European Asbest...

- Consultancy for UK national contract wanted - get...

- Mavis & Ray are on the road again - this time at t...

- CTT Legacy users can now automatically process the...

- Our next-generation asbestos data collection app i...

- Congratulations Cath Tate Cards! Our favourite so...

- Proud of our partnership with CTT Group! What an a...

- We're supporting our partners CTT Group at the Bri...

- UK Government responds to the petition: "A central...

- Support Desk stats for September 2023 show that 19...

- We been helping Student Adventures with their upda...

-

-

-

-

-

-

-

-

-

-

Comments

Post a Comment